This pathbreaking approach to expanding parental choice in education embodies a proposal to amend the Michigan constitution and establish a Universal Tuition Tax Credit (UTTC). The tax credit would offset a portion of private or public school tuition and would be claimed against state tax liabilities. In addition to improving education, the UTTC would save the state hundreds of millions of dollars per year. Unlike other tax credit plans, the UTTC would help needy families with low state tax liabilities by encouraging the creation of corporate scholarships to offset tuition costs not covered by the UTTC. The per-student credit could be claimed against the Michigan tax liability of any person or corporation. Unlike vouchers, the UTTC would not allow state funds to support religious schools, would not drain funds from the public schools, and would not spawn new entitlements or overregulation of private schools. The study includes detailed fiscal models, a discussion of school choice, a history of Michigan's constitutional impediments to education reform, and proposed language for a constitutional amendment. 76 pages

Parental choice in education—whereby parents have the freedom to choose the school their children attend—is seeing explosive growth in popularity and implementation. Instead of sending children to an assigned school based on residence, Michigan parents have asked for and received the ability to send their children to public schools outside their home district and to create new charter schools to meet special needs and interests.

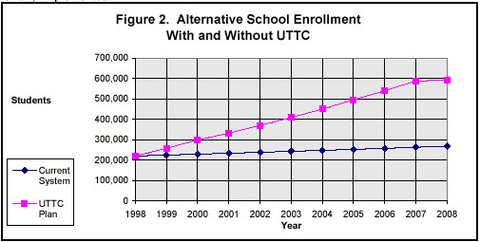

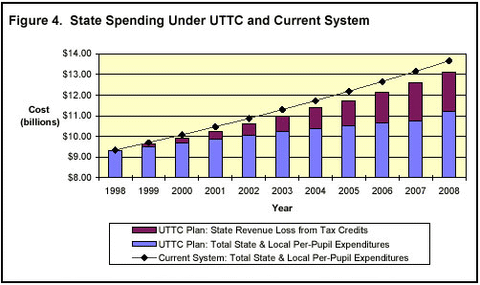

This study from the Mackinac Center for Public Policy presents a path-breaking approach to expanding parental choice in Michigan education. It embodies a proposal to amend the Michigan Constitution and establish a Universal Tuition Tax Credit (UTTC). In addition to improving public education, the UTTC will save the state $3.4 billion in education expenses in the first ten years of implementation and over $500 million each year thereafter. These savings could be used to support additional educational programs, address other budget priorities, or reduce taxes on Michigan citizens or businesses.

Section I reviews why parental choice is the most important systemic education reform and evaluates various ways to expand it. In spite of the fact that parents are entrusted to make vital decisions in nearly every area of their children’s lives, most Michigan parents are unable to make true choices about education, one of the most important aspects of their children’s development. Most children are sent to a government-mandated, government-assigned school.

Choice is the engine for a market economy in all goods and services. The foundation of basic economic theory is the ability of individual consumers to choose one good over another based on their own preferences. Parents prefer good schools over poor schools for their children. Assigning children to schools, based on where students live, deprives parents of the freedom to apply their own values and priorities to selecting a school, and it deprives schools of valuable marketplace incentives that drive continuous quality improvement.

Today, 12 percent of Michigan children—over 220,000—attend alternative schools which charge tuition. Alternative schools include both private schools and public schools; the latter may charge tuition when parents choose a public school outside the home district and the home district superintendent refuses to release funding. The best way to expand parental choice is to eliminate the penalty for parents who must pay twice for alternative schools: once through tuition and then through taxes.

Section II examines Michigan’s constitutional prohibition on including nonpublic schools in an open system of parental choice.

Section III reviews several methods of expanding parental choice. The study concludes that, although both tuition vouchers and traditional tuition tax credits could be used to eliminate the problem of double payment, both have disadvantages. Vouchers, for example, are subject to allegations that they drain funds from public schools, permit state funds to be used to support religious schools, will spawn a new type of entitlement program, and invite overregulation of private schools. Traditional tuition tax credits—whereby only parents are allowed to receive a tax credit—address some of the problems with vouchers, but fail to help low-income and many middle-income families who lack enough tax liability to benefit.

Section III sets forth the details of the UTTC plan. Although both vouchers and traditional tax credits would be an improvement over the current system, the UTTC is designed to capitalize on the strengths and minimize the weaknesses of each. The UTTC has the following features and benefits:

It gradually phases in a tax credit for tuition paid to any Michigan elementary

or secondary school—public or private. It is a direct dollar-for-dollar credit

against taxes owed, not simply a deduction.

The tax credit may be claimed by any taxpayer—individual or corporate. This

includes a student’s parents as well as relatives, friends, neighbors or businesses.

A large company, for example, could pay $2,000 tuition for each of 1,000 low-income

children and receive a $2,000,000 tax credit.

The tax credit applies to three major state taxes: the Individual Income tax, the Single

Business Tax, and the 6-mill state education property tax. These taxes represent state

revenue of approximately $7.5 billion.

It is a per-child tax credit, allowing the full credit to be applied to each child in a

family.

The amount of the credit is limited to the lesser of

Fifty percent of the amount Michigan public schools receive to educate each child. This percentage begins at 10 percent and increases to the 50 percent maximum over 9 years.

Eighty percent of the actual tuition paid. This produces incentives for schools to keep tuition rates reasonable, since not all of the payment will offset tax liability. If the student is from a family whose income is below the federal poverty level the credit is 100 percent of actual tuition paid. This makes it easier for low-income students to benefit.

It does not affect city, county, or township finances.

The UTTC produces significant savings to the state. Since the UTTC will make alternative schools more affordable, more parents will transfer their children from traditional public schools to alternative schools. With the maximum credit limited to 50 percent of per-pupil public school revenues, every student who transfers to an alternative school produces a net savings of at least half of per-pupil revenues. For example, in the 1996-97 school year, the average per-pupil public school revenue is approximately $5,600. The maximum tax credit would therefore be $2,800. If a student transfers to an alternative school, the state must no longer spend the $5,600 and at most loses $2,800 through the tax credit, producing a minimum net savings of $2,800.

Since the average tuition at private schools—which constitute the vast majority of alternative schools—is roughly half of public school per-pupil revenue, the amount of the tax credit provides enough incentive for parents to consider the alternative school option.

Section IV and Appendix I present a comprehensive analysis of the impact of the UTTC on student enrollment and state finances over a 10-year period.

The report includes detailed guidelines and analysis, including:

The complete text of a proposed UTTC constitutional amendment (Section III).

Key elements of the implementing legislation, including sample forms and procedures

(Section III).

Answers to commonly asked questions regarding the UTTC (Appendix II)

When the lights go on in bedrooms across Michigan on early school day mornings, young children are roused from their beds by their parents. During that day, these parents will be called upon to decide what foods their children will eat and what foods they will avoid. These parents will decide with whom their children will play, how much television they will watch, and how much homework they will do. These parents will decide which physicians will treat their children’s injuries, which dentists will check their teeth, and which baby-sitters will care for them in the parents’ absence. As their children grow, these parents will help them decide which clubs and organizations to join and which courses of study to pursue. As the young people approach high school graduation, these parents will offer counsel regarding future educational and vocational pursuits.

Yet in spite of the fact that parents are entrusted to make vital decisions in nearly every area of their children’s lives, most Michigan parents are unable to make true choices about one of the most important aspects of their children’s development. For 180 days of the year, most children are sent to a government-mandated, government-assigned educational institution.1

But slowly, things are beginning to change. Historians who look back on the 1990s may well view this decade as one of true educational reform—a turning point when Americans not only talked about reform but individually and collectively made choices about their schools and the quality of American education.

Although it has been decades in coming, educational choice is breaking out all over America. Milton Friedman, in Capitalism and Freedom, kicked off the modern school choice debate in the 1960s by proposing educational vouchers.2 Parental choice in education involves a broad umbrella of plans, which enable parents to make choices about the education of their children. A Heritage Foundation review of parental choice programs throughout the states indicates that school choice or open enrollment legislation was introduced or pending in 28 states in 1995. 3

The choices parents and their children are making go beyond the selection of another school within the same district. Throughout the country, families are taking advantage of charter schools, voucher systems, tuition tax credit plans, and other innovations providing for public and private school choice alternatives to traditional government schools. Wisconsin and Ohio have instituted new choice options for some of their urban parents. Vermont, on the other hand, continues private and public school choice options for many of its rural citizens under a program started in 1869.4 In 1997 both Arizona and Minnesota approved educational tax credits. Arizona now allows a credit of up to $500 for donations to organizations that provide scholarships to private school students. The Minnesota plan allows families with incomes of $33,500 or less a $1,000 per child ($2,000 maximum per family) tax credit for tutoring, textbooks, transportation, computers, and instructional materials. Families with incomes of more than $33,500 receive a tax deduction (up to $2,500) for private school tuition as well as the expenses covered under the tax credit.

In Michigan, parents now have the option of sending their children to public school academies, also known as charter schools. In fact, 1996 could easily be designated the year of the charter school in Michigan. As 34 new charter schools opened their doors in Michigan in 1996, bringing the total number of public school academies to 78, a small segment of parents and school-aged children enjoyed increased educational options.

In the post-Civil War period, the concept of a common-school system was advocated as a "right" and then institutionalized in the early 1900s as a mandate in many states for children from ages 6 to 17. Since that time, students and parents who have made use of the public school system have been generally assigned a specific school. The first such assignments were informal, based on the availability of schools for a particular area. Later, as American cities became more cosmopolitan and students living in rural areas had better transportation and access to schools, such assignments were based on where the school-aged children lived in relation to the schools; in many cases, two children residing on opposite sides of a street might attend different schools, depending on where the school district lines were drawn.

Indeed, much of American history is reflected in the gradual movement from wholly private schools to community schools that were similar to private schools today and then to government-mandated "public" schools that were supported by taxpayer dollars and filled by government assignment and compulsory education laws. As the United States grew more urban and professional, so too did its school system. At the same time, the individual and community autonomy melted away as state governments—and more recently national governments—assumed increasing authority. As government became more powerful, political calculations dominated the design of school systems. The exclusion of American blacks from many public schools is but one unpleasant consequence of this dominance of government and politics in schools as is the rise of the suburban school districts as "asylums" from the city.5 While government schools achieved some of the goals of the common-school movement, they also brought with them many ills.

This study uses the terms "alternative school" and "alternative school student" to refer to any situation where tuition is paid for a student to attend a nonpublic or public school. Some public schools charge tuition when parents choose a public school outside the home intermediate school district and the home district superintendent refuses to release funding. The vast majority of alternative school students, however, are in private schools. In either case parents pay tuition to the school.

Although parents have always had the option of sending their children to alternative schools, often wealthier parents were the only ones who could afford to take advantage of this opportunity with the hope of providing a better education for their children than the assigned public schools might provide. Parents who elected to make use of the assigned public schools could make choices about their schools only by choosing where to live; in fact, home buyers with children have long identified the quality of the local school district as one of the primary considerations when choosing a home. Yet here, too, parents experienced financial constraints because the cost of property tends to be higher in the better school districts. Thus, a system of "assignment" has left parents in a relatively passive role in relation to school selection. It was only with the advent of school choice programs that children attending many public schools began to enjoy some of the choices that their more economically advantaged counterparts enjoyed all along.

Parents can choose to send their children to alternative schools in an assignment system, but they effectively have to pay twice. They pay tuition out of their pockets, and they pay property, income, and sales taxes, which go toward the support of the government education system. In Michigan today, Proposal A and its accompanying legislation did reduce the property tax burden shouldered by many Michigan citizens and businesses. However, the proposal did not eliminate the double payment situation since Michigan citizens must still pay the higher sales tax and the property taxes dedicated to support the government school system. 6

Parents can also exercise choice in an assignment system by selecting a residence in a school district they desire. However, this is still a very limited choice and unavailable to many families, especially those in lower income brackets who cannot afford homes in desired school districts.

In their daily lives as consumers, people make decisions about the products they consume. As the markets in these various products have expanded over the years, manufacturers have given consumers more choices in order to compete with other companies. Competition causes quality to increase and firms to operate more efficiently. The growth of the advertising industry on Madison Avenue can be attributed to the increased number of choices and the need to measure and compare them. 7 Choice is the engine for a market economy in all goods and services. The foundation of basic economic theory is the ability of individual consumers to choose one good over another based on their own preferences. Parents prefer good food for their family over poor food. As a result of economic freedom, they have the right to choose better food, even if it means that better restaurants and grocery stores thrive while others close. Parents prefer better automobiles over poorer ones. They have the right to choose the cars they want, even if it means that some auto-makers expand production and others close plants. Parents prefer good schools over poor schools for their children. Why shouldn’t they have the right to choose better schools for their children?

The empowerment and transformation of parents into active agents is the foundation of educational choice theory. As a review of any literature on the subject of choice will indicate, parents are the primary advocates for school choice. A strong correlation has long been noted between parental involvement and children’s success in school. Parents who advocate choice have asserted consistently that they consider their children’s education a significant responsibility. The concept of choice takes full advantage of parents’ valuable knowledge about their children and their respective talents, abilities, and learning styles. This information equips parents to make optimal choices about where their children should attend school and what kind of school might best suit their children’s temperaments. Parents thus have the opportunity to become active agents in their children’s education. Rather than be intimidated by this responsibility, parents who are able to make choices about schools generally feel empowered, which allows them to continue to play a full, active role in their children’s education. 8

A second reason parental choice works is that it allows educational programs to be tailored to the needs of individual students, not simply provided as a one-size-fits-all package. In what has become one of the seminal works on the educational choice movement, Politics, Markets, and America’s Schools, John E. Chubb and Terry M. Moe explain that the system of public education created in the early twentieth century "was bureaucratic and professional, designed to ensure, so the story goes, that education would be taken out of politics and placed in the hands of impartial experts devoted to the public interest. It was the ‘one best system.’"9 As they argue against the one-system concept, Chubb and Moe emphasize the role that a market system could play in education:

A market system is not built to enable the imposition of higher order values on the schools, nor is it driven by a democratic struggle to exercise public authority. Instead, the authority to make educational choices is radically decentralized to those most immediately involved. Schools compete for the support of parents and students, and parents and students are free to choose among schools. The system is built around decentralization, competition, and choice.10

The work of Chubb and Moe underscores a basic tenet of choice—the idea that competition will enhance the diversity and the quality of the entire educational system. As parents choose schools for their children, the schools they leave behind are forced to improve in order to compete; engaged in competition, these schools provide the energy for their own regeneration, thus improving the entire educational system.

The market approach that provides the philosophical underpinnings for the concept of school choice acknowledges the truth about children as students: that they have different educational needs and learning styles, and that they have a right to seek out a school that will best match their needs and aptitudes. The market system can offer diversity in the type of education offered to students as well as improved quality of the schools.

Gary Becker, the Nobel Laureate in Economics, addressed the "human capital" aspect of school choice in a presentation in Grand Rapids, Michigan, on October 24, 1996.11 Human capital is the investment in training, education, health, values, and other aspects of human potential. Human capital investments increase the ability of people to create wealth.

Becker called the current century the "age of human capital," citing the tremendous growth in investment in human capital in this century, and the resulting huge increase in wealth. He noted that the widely varying economic growth rates among nations could best be explained by investments in human capital rather than by raw materials or other measures. Immigrants in the United States, he noted, have traditionally sacrificed in order to provide a better education for their children—a vivid example of investment in human capital. Becker noted, however, that the public school "monopoly" is a significant deterrent to further investments in human capital in the United States. He noted the "well documented" quality of private school education, particularly at Catholic schools. In his view, the unavailability of parental choice harms the poor in particular, since they do not have the same ability to move to better neighborhoods or purchase private schooling as do middle- or upper-class parents. He suggested vouchers as a workable solution to this problem, since they would enable parents to choose where to send their children.12 Finally, he noted that the improved competition would not only benefit the children who moved to private schools, but also the children who remained in the public system.

Becker’s remarks support a tuition tax credit plan in the State of Michigan as presented in this study. While this study argues that tuition tax credits are superior to vouchers, their ability to empower parents to improve their children’s education is roughly the same.

Although parental choice emerged as a major public policy issue in the late 1980s, Michigan parents, like those in most other states, have always had some options in schooling their children. Parents have always been free to choose private schools for their children in lieu of sending them to government-funded public schools, although such choices required extra expenditures. Inner-city religious schools have long been a source of pride for cities and the religious denominations they represent because of the high-quality education these schools offer. Likewise, the more "elite" private academies in our state, such as Cranbrook or Detroit Country Day School, offer students a strong academic education and grant a small number of students need-based financial aid.

Recent innovations have expanded parents’ options. Many families seeking alternative forms of education for their children have been aided by private scholarships provided by such entities as the Vandenburg Foundation, now known as CEO Michigan. According to Scott Gordon, Executive Director, during the 1997-98 school year, CEO Michigan awarded 462 scholarships statewide to students in 110 schools and 35 cities.13 These scholarships are available to parents who choose any school. Scholarship amounts are $1,000 per year, and the recipients may receive the grant in successive years of schooling. Although the aid is still less than that needed for tuition at an alternative school, it is enough to enable many parents to place their children in an alternative school of their choice.

Located in Detroit, Cornerstone Schools were organized by a coalition of church groups, with support from businesses and community organizations, to offer educational opportunities to children from low-income families. First proposed by Adam Cardinal Maida in 1990, the schools have a Christian, though not explicitly Catholic, orientation. The curriculum is rigorous and is spread across an 11-month school year. The three schools established by the coalition offer assistance to students with a Partner Program, which matches each student with a partner who provides a $2,000 grant to help defray the cost of tuition. The board of the organization, chaired by Michigan School Board member W. Clark Durant, is supported by monetary grants from 270 individual and corporate partners, including the Big Three auto-makers, Blue Cross and Blue Shield, and Detroit Edison. Partners provide more than monetary assistance, however. They also serve as a positive influence in the students’ lives. Meetings between partners and students are arranged four times each year. During the 1996-97 school year, 409 students were enrolled in the Cornerstone Schools.

The success of Cornerstone Schools in creating a quality educational opportunity in an urban setting has won widespread acclaim. The organization has received awards from the Clinton Administration’s National Education Commission on Time and Learning, along with Republican House Majority Leader Dick Armey’s third annual "Freedom Works" award.14

Unlike the system of elementary and secondary education, our system of higher education in Michigan has long been a system of choice. Graduating high school seniors have always had the opportunity to choose the schools, public or private, to which they apply for admission. It is important to note the many reasons behind students’ choices of college, including financial circumstances, the students’ interests, and the students’ high school achievements. Parents and their graduating seniors survey a full range of options, knowing that because individuals differ, the institutions they attend cannot and should not all be homogenous. No government entity could ever weigh properly all these factors for each individual student and impose its choice. Yet, the government attempts to do exactly that for primary and secondary school students.

The success of the choice model for higher education is partly based on the relative freedom in financing options. The 1970 Amendment to the Michigan Constitution represses virtually all direct or indirect financial support for students attending private schools. No such prohibition exists for higher education, and in fact, a wide range of government financing options are available to students at public and private colleges, even private religious colleges. These include government-subsidized loans and grants, tuition tax credits, and direct government aid to colleges and universities.15 While the direct aid for public colleges generally makes their tuition costs lower than those at private colleges, the existence of tuition tax credits and taxpayer-subsidized loans and grants has helped students exercise choice in higher education. One might question why the 1970 Amendment prohibits an 18-year-old student from getting a tax credit for tuition at a high school but allows it for college tuition.

In 1991 Michigan passed legislation that encouraged public school districts to experiment with intra-district school choice options. Intra-district choice allows students to apply to attend other schools within the same school district. Inter-district school choice, which allows students to apply to attend schools in other school districts, was rather limited in Michigan until 1996. In June of 1996, the governor signed Senate Bill 851, the annual appropriations bill for school aid, which authorized inter-district schools of choice within intermediate school districts. School districts within the intermediate school district can make decisions about the extent to which they will participate in the inter-district choice program. Since the 1996-97 school year is the first year of the program, significant data are not yet available, but the existence of the program gives at least some parents yet another option to pursue as they decide on their children’s schooling.16

Some parents have also been able to send their children to traditional public schools in other intermediate school districts. This, however, requires the permission of the receiving school district superintendent and, if funding is to be released, the permission of the home school district superintendent. If funding is not released, the receiving school district may charge the parents tuition. For example, Rory Pettipas was refused a funding release by the Meridian School District superintendent when his parents chose to enroll him in a gifted and talented program at Handley Elementary School in the Saginaw Public School system. His parents were charged $1,800 tuition. 17

Perhaps the most promising expansion of parental choice in Michigan occurred in late 1993 when the Legislature passed charter school legislation as part of a package of bills reforming educational programs and funding. Enacted in 1994, the current public school academy statute gives state public universities, community colleges, and intermediate and local school districts the authority to contract for the creation of "public school academies" or charter schools, to provide education to Michigan’s students.18 During the 1996-97 school year, 76 schools were operating under school charters. Although several universities, most notably Central Michigan University, have granted charters to establish schools, few school districts have exercised this option.

The growing number of charter schools and the expanded choice options offered to Michigan residents are promising developments, but they were not achieved without struggle, turmoil, and acrimonious debate. Given the long and established history of public education, it is not surprising that the concept of expanded educational choice is threatening to some. Though Americans pride themselves on their innovations, advancements, and entrepreneurial spirit, we are still, as Chubb and Moe point out, a people who cling to our perceived heritage, our institutional underpinnings, and our founding creeds, even when the institutions we have inherited are no longer serving us well.

Some of those individuals and organizations that are opposed to the implementation of choice assert that parental choice will eventually lead to the disintegration of the entire system of public education. They argue that the system has served America well for years, and should not be significantly changed. In this century, it is true that a strong public school system has been one of the bedrocks of American society, serving as a cohesive force in a heterogeneous society and enabling people with varied backgrounds to live together in support of common goals and values. This government school system, which grew up from a network of local community schools, has traditionally been a place that offers not only a basic education in subjects such as reading and math, but also an education in citizenship and the workings of American government. However, that legitimate concern has in some cases given way to an overreaction against parents and others who believe they should pursue better alternatives.

Chester Finn, a senior fellow at the Hudson Institute and noted school reformer, has summarized the overreaction of some protectors of the current system in various states:

A Queens, New York couple was charged with fraud for enrolling their 12-year old in a

different school system.

The public schools in Morrisville, Pennsylvania pay a $500 bounty on nonresident

students who are fingered for attending better schools without permission.

A Cleveland mother was actually jailed for putting her son in a neighboring school

district "because I wanted him to have a better life and a better education."

Illinois now has a criminal statute for "illegal school registration," a

misdemeanor punishable by jail and fines.

Finn concludes:

Fortunately for children, school choice is spreading despite the system’s efforts to stop it. And spread it should. There is no reason to confine children, against their families’ wishes, in a bad school when there’s a good alternative on the next block, in the next town, or even in the next state.19

Other overreactions have appeared as well. Today, it is not unusual to see supporters of school choice, especially voucher supporters, to be labeled as "extremists" and lumped together with Ku Klux Klan members or termed a member of the "radical right." The chief lobbyist for the Michigan Education Association (MEA), the state’s largest public school employee union, has said that anyone who supports educational vouchers is "basically racist in nature."20 The MEA also threatened to blacklist teacher education students at a public university if that university chartered public school academies contrary to the MEA’s demands.21 One innocuous-sounding group, the "Coalition for Democracy," supported heavily by the two main teachers’ unions in New York, even has a list of "extremist" groups, which includes such organizations as the Concerned Women of America, the National Association of Christian Educators, and an all-purpose listing for "Taxpayers’ Association: (list specific name.)"22

Of course, the majority of those who defend or work in the public school system do not fall victim to these extreme overreactions. Most are rightly concerned with the quality of education and want it improved. Even among the more thoughtful opponents of parental choice, however, there are several misconceptions that can be dispelled by a review of the experience with parental choice around the nation.

One of the major fears that critics voice about implementing a widespread parental choice program is the notion that it will hurt minorities and economically disadvantaged students and benefit only those who least need it. The evidence demonstrates overwhelmingly that this is not the case. In his review of the Milwaukee Choice Program, Daniel McGroarty points out that through the first four years of Parental Choice in Milwaukee, an average of 92 percent of all children receiving choice vouchers were African-American or Hispanic.23 Chester Finn reports that in a sample of almost 8,400 charter school students across the states, 63 percent were members of a minority group.24 Many existing private schools located within cities have already opened their doors to minorities and the economically disadvantaged, offering full tuition scholarships to those demonstrating need. In addition, charter schools in Michigan and across the nation have been created expressly to serve populations that have traditionally been locked into an assigned government school. Fears of creating an elitist system are unfounded. Expanded school choice programs increase rather than decrease the range of students taking advantage of alternative schools.

A second charge made by opponents of expanded school choice is that it will somehow de-fund the public school system, resulting in its financial bankruptcy or an inability to pay for essential programs. Of course, it is true that choice will allow dollars to follow students. In nearly all states participating in inter-district choice programs, the funding follows each student from the original school district in which he or she resides to the chosen school and its district. This, necessarily, results in a reduction of the overall grant to the original school district, and an increase in the resources to the school receiving new students. For example, due to the opening of two large charter schools in the mid-Michigan area in the 1996-97 school year, the Lansing School District experienced a "loss" of just under four million dollars in state aid when approximately 700 students left the district.25 Of course, these new charter and other public schools "gained" the same amount of money as was "lost" by this school district. Thus, the government education system as a whole did not lose money, and parents and their children gained an increase in options.

When choice is extended to private schools, even more resources are deployed for education. Dollars follow the students, although in a more indirect manner. Other dollars, from private sources, also flow in. Thus, even when choice options include private schools, the overall resources devoted to education need not decrease.26

The dynamic of school choice improves the whole system because competition favors the consumer in every market. The market for education is no different.

Competition has certainly improved the products and services of other industries. In the 1980s, U.S. automobile manufacturers were faced with increasing competition from Japanese car makers, who produced safer, more efficient, and more reliable products. In response to losing significant market share, U.S. automobile manufacturers simultaneously formed partnerships with foreign manufacturers and launched extensive efforts to improve their products.27 Thus, competition brought about improvement in products offered by all manufacturers—both national and foreign. Today, U.S. manufacturers again lead the world in many markets.

Now consider the Lansing School District discussed above. In response to "losing" 745 students to other districts and charter schools in the 1996-97 year, the Lansing School District is creating more options to offer its residents. The school district has added a sixth grade to one of its existing elementary schools and plans to pilot several more K-6 schools in the coming year. In addition, the school district is considering offering all-day kindergartens in some of its elementary schools. Finally, in the ultimate tribute to the power of consumer choice, the district has launched an advertising campaign to showcase its new and improved offerings.28 In the case of the Lansing School District, the exercise of choice options by about 700 students has generated better programs for the over 17,000 who remain in the traditional schools.29

One of the strengths of parental choice is that—just as a restaurant need not lose all of its customers before the chef gets the message—even a small number of students choosing an alternative school can send a powerful message to traditional public school administrators.

The logic that choice options help even those students who stay in the traditional public school system is now overwhelming. A recent "Editorial Notebook" column in The New York Times, subtitled "How Choice Changes Public Schools," confirms how even mainstream opinion has been moved by the evidence now at hand:

In Milwaukee, the threat of expanded competition has worked precisely as Milton Friedman predicted. A system that once treated parents with contempt has begun to answer their calls and embrace local experiments through a charter school and other partnerships with community groups. A city that once rebuffed requests for public Montessori schools now has them. Said John Gardner of the Milwaukee school board: "A system that has been arrogant and indifferent for 20 years has suddenly got religion." 30

Teachers benefit from educational choice because, with a greater number of independent schools, they have more employment choices. Today, if a teacher feels he or she is underpaid, overburdened by red tape, not respected as a professional, or otherwise treated poorly by administrators, the only real option is to leave town and move to another school district. This is because the same employer, the school district, operates nearly all the schools in the area, which practically equates to a monopoly purchaser. With more private and charter schools, however, there will be increasing pressure on school administrators to treat teachers well or risk losing them to competing schools. Teachers can take advantage of better opportunities to teach without having to move their residence.

Another criticism of expanded choice asserts that government schools will be left with the poorest performing, most difficult to educate students—the intractable, the unfocused, the "impossible" individuals. Evidence gathered from school choice programs has not supported this assertion. In the case of the Milwaukee Choice Program, the "skimming" of only "good" or "desirable" students has not taken place. John Witte, who completed several evaluations of the Milwaukee Choice Program, observed that the program seemed to provide an alternative educational environment for students who were not succeeding in the traditional public school. Although Witte’s review of the choice program in Milwaukee is not completely positive, he nevertheless acknowledges that students who were not "making the grade" could always find a place where they were welcome and free to succeed.31 Most schools participating in choice programs, whether they are private, public, or charter schools, seem eager to convey the message long ago inscribed on the Statue of Liberty: "Give me your tired, your poor, / Your huddled masses yearning to breath free . . ."32

Indeed, even The New York Times now recognizes that choice programs offered to economically poor students help them achieve more and pressure the public school system to improve:

Desperate to find a remedy for failing schools, several states are considering voucher experiments that would offer low-income students private-school scholarships at public expense. . . . A study of the longest-running experiment in Milwaukee suggests that vouchers can improve the prospects of the poorest and least prepared students. . . . More work needs to be done to see if the gains are sustained. But the Milwaukee data should serve notice on the teachers’ union—and large, urban districts everywhere—that if the schools do not improve quickly, vouchers could become irresistible.33

If the defenders of the current system are correct in their criticism that choice will hurt the urban poor, we should see urban leaders resisting choice strongly. In fact, just the opposite is the case. In Detroit, Milwaukee, Cleveland, and other cities across the country, urban leaders and parents are at the forefront of demands for choice.

In an essay supporting a modified voucher plan for Cleveland’s public schools, Hugh Calkins, a member of the Cleveland School Board from 1965 to 1969, examines the claim that choice will "skim the cream." Calkins addresses the concern that students who do not take advantage of choice options and remain in their home school may sustain losses that equal and perhaps exceed the gains that those who leave the system may achieve.

I respond that it is intolerable to deny better education to inner city children with the gumption to seek it, in order to help others who are less determined to escape the ghetto. Moreover, the gains and losses are closely related to the degree of involvement that parents have in their children’s education, and providing real choices is the best tool we have to increase the number of involved parents and the intensity of their involvement.34

Mr. Calkins’s comments underscore the danger of focusing primarily on individuals who choose not to make a choice about their schools. It may well be true that those students will, for a time, exist in a school that does not meet their educational needs. But many students in public schools find themselves in this situation right now. The very existence of expanded choice options will bring about changes in the educational environments in the students’ home districts. In Michigan, as charter schools have attracted increasing numbers of students, the traditional public schools have doubled their efforts to "win back" departing students. 35

Mr. Calkins’s words also serve as a reminder that parents should be the primary caretakers of their children’s education, rather than allowing the state to assume that role. Parents deserve the freedom to seek a better education for their children if they think the current system is failing to provide one. Any objection to allowing parents the right to send their children to a better school, because doing so somehow undermines a "system," is significantly flawed. Parents would not accept such an argument with a child seeking medical care: ("But Johnny can’t go to a better doctor; what would happen to the staffing levels at our government-assigned clinic?") People would not accept it for choosing where to live: ("No, I’m sorry, Mrs. Smith, you and your husband cannot move out of town; we need your residency in order to keep up our revenue sharing.") Similarly, it cannot be accepted with respect to education.

In Detroit, local ministers have come together to demand choices in education that extend outside the government school system. A large group of urban leaders, including the former superintendent of the Detroit School District, Deborah McGriff, have traveled to Cleveland and Milwaukee to personally review their choice programs. In both cities, pilot programs offer vouchers to parents of school-age children, which can be used at private schools. The ministers emerged impressed and vowed to support choice programs for their citizens in Detroit. Reverend Edgar L. Vann, President of the Council of Baptist Pastors of Detroit and Vicinity, stated that there is no reason why every school—public and private—"should not be a part of the mix of positive choices available to parents." The Reverend Ned Adams, Jr., pastor of True Faith Baptist Church and a member of the Baptist Council’s education committee, believes that without a choice among private schools, there is no incentive to drive school reform.36 Rabbi E.B. "Bunny" Freedman, former executive director of Yeshiva Beth Yehudah in Southfield, noted that "Parents who send their children to private schools are not getting a fair shake, because they are effectively paying twice for the education of their children." He favors vouchers or tuition tax credits for parents.37

Public opinion supports the ministers’ efforts. A February 1997 poll by the Lansing firm of EPIC/MRA for TEACH Michigan, an organization which supports school choice, found that Michigan residents support state-funded scholarships for poor children to attend any school of their choice.38 The survey of 600 Michigan voters found that 54 percent favored such a plan.39 In Detroit, full choice was favored by an even greater 60 percent.

Economics as a social science explains the behavior of consumers and producers. Both seek to satisfy their own preferences. Producers try to maximize profits. Consumers maximize their own utility, which normally includes cash income, creature comforts, and leisure time. The field of "public choice," a branch of economics, extends these basic findings to the world of politicians, voters, and interest groups.40 A brief public choice analysis explains many of the problems of the current system and points to parental choice as the solution.

Public choice analysis assumes that politicians, although they have a variety of desires, try to maximize their ability to get re-elected. They therefore pay more attention to organized interest groups, the media, and segments of the population which actively participate in politics than to the public at large. This is not to say that politicians are immoral or operate against the wills of the voters. Rather, just as retailers court those customers who have the most to spend in their stores, politicians listen to those who have the most impact on their re-election. In politics, it is the squeaky wheel and, more particularly, the well-funded, influential wheel, that gets the grease.

When this insight is applied to the current public school system, it is easy to see why "the system" as a whole has developed a resistance to competition. There is no organized lobby for parents concerned about their children’s performance.41 There are, on the other hand, a number of very organized, politically active interest groups that support the current system.42 While these organizations—public school employee unions, school board and administrator associations, intermediate school districts, urban and rural school districts—do not agree on all points, they all tend to oppose parental choice and support more money for the current system. Although it is clear that the vast majority of the individual members of these organizations also support better education for children, the vocal lobbying groups representing these individuals are concerned primarily with protecting institutional interests. Even though it is not in the best interests of parents and students, the typical politician responds to the powerful calls for more money for a system that is protected from outside competition.43

Dr. William Allen, Dean of Michigan State University’s James Madison College, analyzed Michigan’s current education system and highlighted the structural deficiencies that prevent citizens from demanding and receiving quality, cost-effective educational services. He notes that "due to the lack of market-like mechanisms," consumers must use the political process. For ordinary citizens in the political process, the costs are high and their ability to influence is limited, when compared to the highly-organized employees of the current system. 44

Thus, it is not surprising that, as the general populace has increasingly noticed the decline in overall performance, the defenders of the system do not wish to embrace the very change that would best address the problem. That change—market competition for students—provides every student a better chance to succeed, but also reduces the power, prestige, and money that accrue to the traditional public school system.

Before concluding that parental choice in education is the best improvement to the system, we should at least consider one alternative: that simply devoting more resources to traditional public schools will dramatically improve their performance. That question has been conclusively answered. Indeed, now even mainstream economists accept that simply spending more money on traditional government schools will not significantly improve education. Edward Gramlich, the Dean of the Public Policy School at the University of Michigan, and a former Acting Director of the Congressional Budget Office, has long been concerned about lagging national investment in human and physical capital. He notes in his 1992 Brookings Distinguished Lecture on National Priorities:

Two types of public consumption seem especially in need of attention—education and health care. In both cases, aggregate measures of performance are lagging badly. In both cases, this lag is in the face of big increases devoted to the problem.

Take first education. There John Chubb and Eric Hanushek make a powerful argument that further resources devoted to the problem without structural reform will simply make the nation’s schools more expensive, not better. Their macro argument is that over the last 30 years real expenditures per pupil have tripled but most measures of test performance have dropped sharply. Their micro argument is that most careful research studies have simply not found any relationship between resource inputs and output measures such as achievement test scores. Presumably the missing ingredient here is some form of performance incentive, but even this is not very clear.45

Gramlich confirms what free-market advocates have been saying for some time: simply putting money into the current system has not worked in the past and will not in the future.46 More recent work, including a comprehensive analysis of Michigan schools by Dr. Allen, again finds a weak relationship between increased expenditures and improved school performance.47

Gramlich, writing in 1992, was not yet convinced performance incentives were the answer. Today, the case for performance incentives is clear and compelling. Indeed, more aggressive reformers go well beyond the parental choice plan proposed herein. They argue that the government school system has completely outlived its usefulness and should be totally replaced. Lewis J. Perelman, in School’s Out, argues that choice is essential, but does not go far enough:

However, the need not merely for "choice" but for commercialization of education has been overlooked by most would-be reformers. We need commercial choice and competition in schools first to goad technological innovation—the profit motive is essential to reward the creation and provision of productive technologies.48

While Perelman argues for outright commercialization, Dr. Allen argues for a new framework of public ownership of schools, in which competition on price and quality would drive the system:

We advocate provisions by which all K through 12 education will be non-governmentally operated. We propose to eliminate all jurisdictional barriers to school selection. No single structure of educational governance would be imposed by the State, even as the State preserves its commitment to equitable funding for Michigan students. Schools will be owned by individual shareholders, who will operate each school acting through their respective boards of directors.49

Thus, we need to change the incentives if we hope to change the outcome.

We need to return power, authority, and responsibility to parents, rather than leaving it vested in politicians and administrators. Parents have the responsibility for the welfare of their children. As choice options have become more widespread, it is apparent that parents are eager to accept the responsibility for their children’s schooling. The problems of our existing public education system—the increase of violence in the schools, the breakdown of communication between students’ homes and the school, the inconsistent level of graduating students’ basic skills—all point to an enervated, overburdened system that needs more than increased funding, administrative tinkering, or pedagogical experimentation. It needs wholesale change in which students and their parents can become an integral part of a new system—a dynamo of improvement.

The Michigan Constitution of 1963, Article VIII, Section 1, states the following: "Religion, morality and knowledge being necessary to good government and the happiness of mankind, schools and the means of education shall forever be encouraged."50 In adopting this language–which sprang from the 1787 Northwest Ordinance–the people asserted that education is vital to our society and that knowledge, morality, and religion are necessary elements of that education.

The very same Constitution, however, and also the U. S. Constitution, place limits on the extent to which the government can support religious activities and organizations. This situation has created a tension between various visions of church and state separation and has shaped the current Michigan Constitutional provision regarding educational options for parents and students, especially with respect to nonpublic schools.

The delicate balance between church and state has been debated and litigated across the country for four decades.51 While it is settled law that the government may not directly support religious instruction, it is also well established that the state can adopt policies which indirectly aid religious institutions, particularly through some form of tax preference.52 The debate over taxpayer financing and private schools in Michigan reached a high point in 1970 and is again headed into the mainstream of Michigan politics. A brief history is instructive.

Since at least 1939, the state had provided indirect support for private schools, for auxiliary functions such as transportation, testing, health, and special services for handicapped children.53 Even prior to that, at least beginning in 1921, some "shared time" classes were held involving both private and public school students, which continued until at least 1970.54 Starting in 1929, however, the state maintained a statutory prohibition on direct support for sectarian schools. 55

Thirty years ago in Michigan, many parents who supported the expenses of their children at private schools and who also supported government schools, urged taxpayer-funded support for private schools. The increasing costs of operating the public school system and paying for private schools created significant support for partial taxpayer funding of private education. The legislature then passed Public Act 100 of 1970, the school aid bill for the year, which provided direct support to eligible private schools, which could be used only for instruction in nonreligious subjects.56 Michigan's law was similar in concept to those passed in a handful of other states, including Pennsylvania and Rhode Island.57

The Michigan Supreme Court quickly upheld the law, ruling in an advisory opinion that "the Constitution of the State of Michigan did not prohibit the purchase with public funds of secular educational services from a nonpublic school."58

The passage of the law then provided impetus for a campaign to amend the 1963 Constitution to prohibit state funds from being used to support education at private schools. A petition drive was mounted by the "Council Against Parochiaid" to place an amendment on the ballot. The petitions were thrown out after a finding by the attorney general, and later the board of canvassers, that the petitions did not let the signers know whether the amendment would abrogate the education section of the Constitution. A split panel of the Court of Appeals, and then a 5-2 majority in the Michigan Supreme Court, ordered the issue onto the ballot. 59

However, a concern for maintaining institutional separation between church and state and avoiding "excessive entanglement" by preventing tax dollars from flowing to religious schools was probably not the only force which drove the ballot initiative. There was a heightened awareness of religious differences at that time in the state of Michigan, and with it came the concomitant concern that state dollars might be used to promote not just private education in general, but a specific religion. Thus the specter of "parochiaid" was born.

The campaign itself was confused and bitter, with the effect of the proposal unclear to the voters as well as to public officials.60 However, the amendment (Proposal C on the November 1970 ballot), was approved by a margin of 338,098 votes: 1,416,838 to 1,078,740. The new language added to Article VIII, Section 2 provided the following:

No public monies or property shall be appropriated or paid or any public credit utilized, by the legislature or any other political subdivision or agency of the state directly or indirectly to aid or maintain any private, denominational or other nonpublic, pre-elementary, elementary, or secondary school. No payment, credit, tax benefit, exemption or deductions, tuition voucher, subsidy, grant or loan of public monies or property shall be provided, directly or indirectly, to support the attendance of any student or the employment of any person at any such nonpublic school or at any location or institution where instruction is offered in whole or in part to such nonpublic school students. 61

The amendment was so restrictive that the Michigan Supreme Court had to determine not only whether it prohibited direct aid, but also whether or not it prohibited the wide variety of indirect services that were shared, supported, or financed by private agencies and the state and federal government. In the Traverse City School District case, the court interpreted the amendment to outlaw direct aid, but to continue to allow indirect and auxiliary services to be performed with taxpayer funding. However, the Court also ruled that a portion of the amendment which prohibits the use of public money to support the attendance of any student or the employment of any person at any such nonpublic school or at any location or institution where instruction is offered "in whole or in part" to nonpublic students was unconstitutional, void, and unenforceable because it contravened free exercise of religion.62 The free exercise of religion is an important guarantee provided by the United States Constitution, and the Court ruled that Michigan voters could not overrule the U. S. Constitution.

With the 1970 amendment, Michigan’s Constitution became one of the most repressive in the country with respect to parental choice involving nonpublic schools. In an attempt to limit state support to religious schools, advocates of the amendment foreclosed the opportunity for nonpublic school educational choice programs that were religion-neutral and consistent with state and federal constitutional requirements. Michigan residents have lived with the result for over a quarter of a century.

The passing of more than two decades has brought about change in Michigan. Nonpublic

schools are attracting more students, support for parental choice in education is growing

rapidly, and it is not clear that 1970s Proposal C would pass in our present day. It is

time to reevaluate the language that is openly hostile and punitive to parents who would

like to send their children to a nonpublic school without having to pay twice.

As demonstrated in the preceding sections, the Michigan Constitution clearly establishes the principle that education must be a top priority of Michigan citizens. Only with a well-educated populace can we achieve the peace, prosperity, and freedom that a constitutional democracy promises.

Since parental choice in education is such an effective method of improving the availability, quality, and efficiency of educational programs, it is vital that Michigan citizens work to provide more educational options for more students. There are essentially four ways to accomplish this: 1) allow parents and students to choose freely between existing public schools, even schools outside the home school district or the home intermediate school district; 2) remove the existing cap on the number of charter schools that may be created and reduce regulations that hinder such schools from starting; 3) implement a tuition voucher program; and 4) implement a tuition tax credit program.

After analyzing the various means of expanding parental choice in education, this section proposes a Michigan Constitutional amendment for a Universal Tuition Tax Credit. This tax credit is "universal" because, unlike traditional tuition tax credits, it applies to

Any Michigan student

Any Michigan elementary or secondary school, public or private

Any taxpayer—individual or corporate; and

Any of three major state taxes: the Individual Income tax, the Single Business Tax, and the State Education Tax (the statewide 6-mill property tax).

As mentioned previously, Michigan law currently permits very limited choice between traditional public schools. Under legislation adopted in 1996, parents may send their children to any school within an intermediate school district, provided that the school district which contains the desired school has elected to accept such students. State funding will follow the child to the school of choice, thereby creating incentive for schools to satisfy parents and students.

However, parents who choose to send their children to a public school outside their intermediate school district may be required to pay tuition to the receiving school if the home school superintendent refuses to release to the school the state funding that would normally follow the student. This creates a financial disincentive for choice that not all parents are able to overcome.

This problem may be solved in one of two ways. A simple solution would be to allow the state foundation grant to follow the student to whichever public school he or she attends, without requiring permission of the home school district superintendent. A second solution would be to provide a tuition voucher or a tax credit to parents who find themselves having to pay tuition to an alternative public school.

Choice among alternative government schools could also be enhanced by lifting the cap on the number of charter schools and by reducing the regulations that make it difficult to start and operate a new school.

Although increasing choice between traditional public schools and increasing the number of charter schools will increase parental choice, both approaches fail to take advantage of the existing nonpublic school infrastructure. Currently 12 percent of Michigan elementary and secondary students are enrolled in Michigan nonpublic schools, institutions that are noted for their efficiency and results, and, in urban areas, are often oases of educational excellence in an environment of under-performing public schools. As with public schools, the quality of private schools varies widely, and of course not all private schools are superior to all public schools. But where the best educational opportunity is a private school, parents should be empowered to choose it for their children.

To engage these schools more fully in the quest for educational excellence, the most effective choice programs must reduce the bias against private schools that is currently enshrined in the Michigan Constitution and state law. The barriers that exist to private school choice have been described in detail in preceding sections.

Where parents choose an alternative school and are required to pay tuition—whether it be to a public school or a private school—the two methods of expanding choice most frequently advocated are the tuition voucher and the tuition tax credit, each of which has its own strengths and weaknesses.

Vouchers

The main strength of a voucher program is that it simply and straightforwardly empowers students who wish to attend an alternative school to do so. Under a voucher program, the state would provide a tuition voucher for a specified amount to any Michigan student who chooses to attend an alternative school. The alternative school at which the student enrolled would submit the voucher to the state for payment. In this way, depending on the amount of the voucher, the student’s parents’ tuition bill would be either reduced or paid in full. Such a system would reduce the injustice of parents of alternative school students paying twice for education, and provide financial means for more parents to choose alternative education that better meets the needs of their children.

However, tuition vouchers present several concerns. First, opponents argue that vouchers transfer public funds to private schools and thereby drain funds from public schools. Related to this is the argument that vouchers transfer public funds, albeit indirectly, to religious schools, raising a question of separation of church and state which concerns many people. These arguments touch upon a critical distinction between credits and vouchers. Under a voucher system, the State of Michigan would end up making payments to particular schools, including religious schools. Under the UTTC system, the State would not make any such payments whatsoever. Individual citizens and businesses would support the schools and students of their choice, and simply pay less taxes to the state as a result. There is no direct transfer of public funds involved.

Voucher opponents also argue that vouchers are more likely than tax credits to create a justification for government regulation of schools. Many people feel that if the state is transferring public funds to a person or organization, the state should have control over how that money is used. This leads to increased regulation of the receiving party. Tax credits and deductions, on the other hand, generate less incentive to regulate the receiving institution. Federal housing subsidies, for example, carry with them many more regulations than the home mortgage deduction. This is because the taxpayer is the one choosing to make a payment of his or her own funds, with only incidental tax consequences. This is not to say that there is no incentive to regulate tax credit or tax deduction programs, but rather that there is less incentive than when direct subsidies are involved. The last thing Michigan educators and students need is for nonpublic schools to be hamstrung with the same burdensome regulations that public school administrators and teachers complain about regarding their schools.

Voucher opponents also claim that vouchers will spawn a new type of middle-class entitlement program, with its concomitant trade associations and lobbying organizations seeking increased government funding. Vouchers present the classic public choice problem of concentrated benefits and distributed costs, providing great incentive for people to spend and little incentive to economize. A tax credit, on the other hand, requires that a taxpayer actually spend his or her own money first, and later pay reduced taxes as a result. There is still political incentive to increase credit amounts, but it is less than when a program involves "free money" sent by the government, such as is the case with many welfare programs.

Some have argued that permitting vouchers for only nonreligious schools would obviate the church and state objections, but that alternative is met with its own shortcomings. First, it would directly contradict the sentiments of Art. VIII, Sec. 1, which state that "Religion, morality, and knowledge being necessary to good government and the happiness of mankind, schools and the means of education shall forever be encouraged."

Furthermore, such a provision may be unconstitutional on U. S. Constitution First Amendment Free Exercise grounds. The Council Against Parochiaid was careful in constructing Section 2 as a religion-neutral provision, and even so, part of it was held to violate the Free Exercise clause.63 In addition to constitutional concerns, such a provision would probably alienate many in the religious community, and it would enshrine in the Constitution disparate treatment of nonpublic sectarian and nonpublic nonsectarian schools. This is poor precedent, even if constitutional.

Traditional Tax Credits

The traditional tuition tax credit—whereby only a parent can claim a credit against his or her personal income tax for school tuition—requires no expenditure of public funds and therefore avoids or minimizes many of the problems with vouchers. Since the parent is paying the tuition directly, there is no transfer of public funds to religious schools, less incentive to create a new entitlement program, and less justification to regulate the nonpublic schools beyond current law.

The main weakness of the traditional tuition tax credit is that it fails to provide effective choice for low-income, and even many middle-income, families. These families simply do not have enough income tax liability to take advantage of a tuition credit.

The Mackinac Center for Public Policy has monitored the national educational choice movement for a decade and has developed an approach informed by the successes and failures of choice programs in other states as well as an understanding of Michigan politics and the economics of public choice.

To overcome the weaknesses of both vouchers and traditional tax credits, the Mackinac Center for Public Policy has developed an amendment to the Michigan Constitution which would establish the Universal Tuition Tax Credit (UTTC). When adopted, the UTTC will greatly expand quality educational opportunities for all Michigan students while reducing government expenditures for education. As discussed below, the UTTC is superior to vouchers, traditional tax credits, and other methods of expanding parental choice in education.

The Universal Tuition Tax Credit is based on the simple principle that Michigan citizens and businesses should make education a priority, and that those citizens and businesses that are already making education a priority should not be penalized or taxed unfairly. This occurs today when parents and others are forced to pay twice when they support nonpublic schools and when they pay additional tuition to send their child to a public school outside their home school district without a release of funds. The UTTC establishes basic fairness by allowing parents and others who choose an alternative school—public or private—to do so without being penalized. The UTTC will expand the effective options for parents and students so they may choose an educational opportunity that best meets their needs. As described here, the UTTC will benefit both public and nonpublic schools.

Unlike a traditional tuition tax credit that may be used only by parents to offset only their personal income tax, the UTTC is "universal" in character. It may be used by any Michigan elementary or secondary school student. It may be used for tuition paid to a public or private school. It is applicable against three separate state taxes and may be applied universally by any state taxpayer—individual or corporation—that pays tuition for a Michigan student to attend an alternative Michigan elementary or secondary school. The credit may be applied to the state individual income tax,64 the Single Business Tax,65 or the State Education Tax.66 It is important to recognize that the UTTC is a tax credit, not a tax deduction. This means that it can be subtracted directly from the taxpayer’s tax liability, not simply used to reduce the basis of the tax. Therefore, if a taxpayer has a pre-credit tax liability of $3,000 and a tuition tax credit of $2,000, the taxpayer would pay tax of only $1,000.

The UTTC plan can be accomplished using the existing tax system and, with slight modifications, the existing mechanisms for tax payment, refunds for overpayment, enforcement mechanisms, and credits. Significantly, the Michigan Individual Income tax already allows tuition tax credits for tuition paid to certain colleges and universities. The UTTC modifies and extends this tax credit to elementary and secondary schools. The income tax already allows credits for property taxes (the "Homestead" or "circuit breaker") and home heating costs. The property tax credit alone accounted for $435 million in tax credits in 1993. Other credits are allowed for artwork, certain community foundations and homeless shelter donations, contributions to colleges and universities, and medical savings accounts.67 Similarly, the Single Business Tax provides for a variety of deductions and credits.

The UTTC is very simple and straightforward. When a taxpayer pays tuition for a Michigan child to attend an alternative school, that taxpayer may claim a portion of the tuition paid as a credit against the tax liabilities mentioned above. The credit is non-refundable; that is, only taxpayers who owe taxes can claim the credit. Taxpayers who do not owe taxes cannot receive a "refund" from the state. The amount of the credit is limited under the plan in two ways.

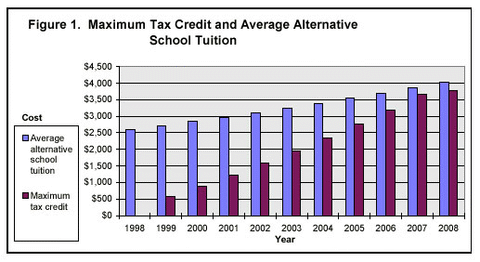

First, the maximum allowable credit per child is phased in over a period of nine years, starting at 10 percent of the average amount received by state and local government per child in the Michigan public school system and eventually equaling 50 percent of the average per-child revenue. Thus, the tax credit will never be more than half of the amount received per child in the public school system.

To demonstrate with a simplified example, Table 1 shows the amount of the credit over a period of 9 years based on a constant annual per-child public school spending of $6,000 (this amount would actually increase each year). The purpose of the phase-in period, as described later in this report, is to minimize impact on the state budget.

| Table 1. Example of Nine-Year Phase In of Universal Tuition Tax Credit | |||

| Year | Average Per-Pupil Public School Revenue | Maximum Credit as a Percentage of Per-Pupil Revenue | Maximum Credit |

| 1 | $6,000 | 10% | $600 |

| 2 | $6,000 | 15% | $900 |

| 3 | $6,000 | 20% | $1,200 |

| 4 | $6,000 | 25% | $1,500 |

| 5 | $6,000 | 30% | $1,800 |

| 6 | $6,000 | 35% | $2,100 |

| 7 | $6,000 | 40% | $2,400 |

| 8 | $6,000 | 45% | $2,700 |

| 9 | $6,000 | 50% | $3,000 |

| 10 | $6,000 | 50% | $3,000 |

Secondly, the credit is limited to 80 percent of the tuition paid, unless the student is from a family whose income falls below the federal poverty level, in which case the credit is 100 percent of the tuition paid, up to the maximum allowable credit. Requiring a non-creditable payment of 20 percent of the tuition for non-poverty-level families provides downward pressure on the cost of tuition, helping keep education efficient and affordable. The credit for students whose family income is below the federal poverty level is limited only to the maximum credit amount, making it easier for taxpayers to assist such students.

The state Legislature and the Michigan Department of Treasury would develop the administrative procedures for implementing the UTTC. Such procedures should include the following provisions, described in detail in the section "Legislative Implementation of the UTTC" below:

Allow individuals and corporations the option to make one annual payment to a nonprofit

scholarship organization or charitable foundation which acts as a conduit to make direct

tuition payments and handle recordkeeping. This will remove from businesses and

individuals the administrative burden of supporting multiple students at multiple schools.

Modify the state Individual Income tax form to provide a convenient way for individuals

to claim credit against their Individual Income taxes and state education property taxes.

Modify the Single Business Tax form to provide a convenient way for businesses to claim

credit against their Single Business Tax.

Create a method whereby businesses and individuals can claim credit against the state

education property tax.

Provide for a standard receipt to be issued by alternative schools that will track tuition payments to each identified student and the maximum credit allowed for that student. This will assure that credits are accurately tracked and guarantee that the tuition payer can claim the proper credit.

The UTTC has several distinct benefits:

The UTTC will vastly expand parental choice in education in Michigan, bringing with it

the dynamics of consumer choice and a competitive educational marketplace. It will result

in marked increases in educational quality, educational opportunity, and parental

involvement.

The UTTC overcomes the shortcomings of traditional tuition tax credits by allowing both

parents and non-parents to obtain tax relief when they support a student at an alternative

school. By allowing the credit to be applied to three state taxes by any taxpayer, the

additional money that could be dedicated to alternative school education would be

significant. For Fiscal Year 1996-97, for example, the amount would be over $7.5 billion.68

Friends and relatives of a student could pay all or part of the student’s tuition at

an alternative school and receive credit against their Individual Income tax, state