There are allegations that Michigan lawmakers are suffering a bout of “tax cut fever” that has slashed taxes over the decade. These accusations are a way of degrading the intentions of people who would rather keep more of their money than be forced to give it to Lansing. Considering the state’s financial situation, there is more of an outbreak of tax cut phobia than fever.

The state is on its fifth year of an economic recovery that drove up tax revenue. Income tax revenues are collecting $3 billion more than they did just four years ago. Preliminary revenue estimates show another $1.4 billion in tax revenue for the upcoming fiscal year above fiscal year 2014.

Moreover, to say that policymakers have been cutting taxes like it’s going out of style relies on a bad definition over what constitutes a tax cut.

Some say it includes subsidies to selected businesses in the form of refundable tax credits. The treasury will have less net revenue because of these incentives. But in order to give out money in these tax credits, government must raise tax money elsewhere.

By increasing a tax credit somewhere, the state would still be extracting just as much revenue from the general taxpayer. Giving out subsidies through film credits, for instance, may mean less revenue for Lansing, but it matters little to taxpayers who still have to finance those expenditures.

The most extreme example is in the Michigan Business Tax. This “tax” is only filed by companies that have received special tax credits. Because of this, it does not raise revenue — it pays it out. The state expects that it will have paid out $734 million to those tax filers in fiscal year 2014. In order to pay out these credits, this money has to come from other taxpayers.

The difference will be important in the upcoming sales tax ballot proposal. Part of the package will ask voters to increase in the Earned Income Tax Credit. This has been promoted as “tax relief.” The credit will deliver cash from general taxpayers to those filers who have low incomes and children, regardless of their tax burdens. Often, these credits deliver more cash than the recipients’ tax liabilities. This is taxpayer-financed assistance and qualitatively different from easing tax burdens.

Moreover, allegations that legislators have “tax cut fever” ignore the state’s tax increases from the past decade.

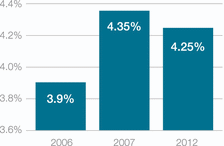

The state increased its personal income taxes in 2007 from 3.9 percent to 4.35 percent. This was initially a temporary tax increase that was made perpetual in 2012 after phasing down to 4.25 percent.

The state also increased its business taxes by 22 percent in 2007.

When it comes to easing the burden of taxation, only the move from the Michigan Business Tax to the Corporate Income Tax applies.

So over the decade, it’s 2-1 in favor of tax rate hikes. It is strange to say that Michigan legislators have been suffering from a tax cut fever.

But the state has also changed some of its broad-based exemptions over the period that some may consider tax cuts and tax hikes.

The 2011 tax reforms took away exemptions for pension income, and reduced and eliminated a number of smaller exemptions.

Proposal 1 of 2014 eliminated personal property taxes on small business establishments and will phase out these taxes on industrial businesses. These taxes will still remain unmitigated for larger commercial entities and utility providers, and even industrial businesses benefiting from these reductions will still pay some taxes on their business equipment.

Even including these changes for exemptions, the story of Michigan’s past decade is one of tax increases and not “tax cut fever.”

Yet calling it an illness denigrates the intentions of the people who support lower taxes. Finding ways for governments to spend less and let people keep more of their earnings is a noble cause. Those who want this ought not to have their intentions written off as pathological. Especially when reducing taxes is an affordable option.

#####

James Hohman is assistant director of fiscal policy at the Mackinac Center for Public Policy, a research and educational institute headquartered in Midland, Mich. Permission to reprint in whole or in part is hereby granted, provided that the author and the Center are properly cited.

The Mackinac Center for Public Policy is a nonprofit research and educational institute that advances the principles of free markets and limited government. Through our research and education programs, we challenge government overreach and advocate for a free-market approach to public policy that frees people to realize their potential and dreams.

Please consider contributing to our work to advance a freer and more prosperous state.