The Issue at Hand

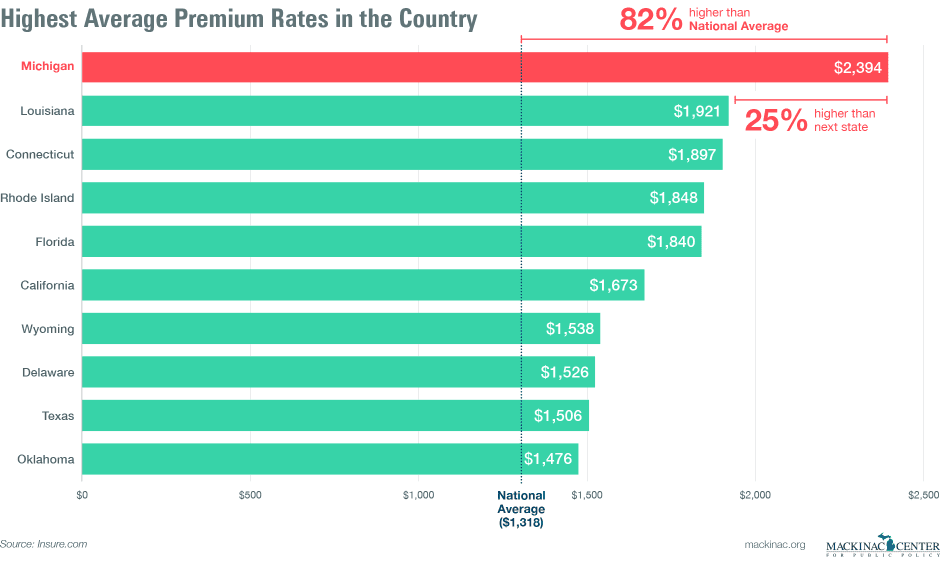

It’s no secret that Michigan’s no-fault auto insurance system has problems. Michigan drivers pay some of the highest insurance premiums in the country.

It’s no secret that Michigan’s no-fault auto insurance system has problems. Michigan drivers pay some of the highest insurance premiums in the country.

Premiums are so costly, in fact, that an estimated one in five vehicles in Michigan is driven by an uninsured driver.

No other state in the nation requires drivers to purchase coverage that provides unlimited benefits — this despite the fact that only a tiny fraction of drivers will ever cash in on those benefits.

Even the primary purpose of using a no-fault system — reducing lawsuits and court costs — no longer holds in Michigan: Auto-related lawsuits are on the rise.

Clearly, reform is needed.

The Michigan Legislature appears ready to tackle this issue and pass reforms that would work to drive down premiums in Michigan.

Remove the requirement that all drivers purchase expensive, unlimited coverage that few will ever need.

Remove the requirement that all drivers purchase expensive, unlimited coverage that few will ever need. Allow drivers to opt out of purchasing medical coverage if they are already covered by their health insurer.

Allow drivers to opt out of purchasing medical coverage if they are already covered by their health insurer. Control medical costs by limiting what providers can charge to the rates set by the state’s workers’

Control medical costs by limiting what providers can charge to the rates set by the state’s workers’